January got everyone’s attention. A declining stock market always gets attention and last month the S&P lost 3.4% after a 30% increase in 2013. The Dow Jones Industrial Average lost over 5% and foreign stock markets were down as well.

As usual, pundits are falling all over themselves assigning blame for the sell-off in January. The reality is that the market has had an incredible bull run for the past five years, so investors taking profit should not surprise anyone.

The following graph appeared in my December Investment Commentary. It illustrates the rally that started at the end of February 2009. The S&P 500 increased 168% since the market bottomed less than five years ago!

After last month’s decline, the chart now looks like this. There’s nothing unusual about profit taking. It’s normal. It’s expected. It’s not financial Armageddon.

There are several reasons being thrown around as causes for the market decline. Some of them are legitimate concerns, but not necessarily the reasons behind a market sell-off that was long overdue.

- Emerging markets – several less developed nations have not been managing their finances very well (perhaps they were using developed nations as a guide?). A few of them (Turkey, Argentina, India and Brazil) have imported quite a bit more than they have exported, developing large trade deficits. This is not an economic global crisis, and there are many emerging market nations that are doing quite well, thank you. Emerging markets are the first “headline risk” this market has faced in over a year, but they are not the reason for the January stock market decline.

- China – the largest “emerging market” (although you can’t really call China an emerging market since it will soon have the world’s largest GDP) is experiencing slower growth. This is not a surprise. You can’t sustain 10% growth per year, every year while building empty apartment buildings and highways to empty towns. Any country needs to have consumption comprise a significant part of GDP. China is not the reason for the January stock market decline.

- The U.S. economy began to stall in January. Well, what did you expect? It was FREEZING! And so is February! Who wants to go outside and do anything? Auto sales were down. Durable goods orders were down. Natural gas prices were up. Don’t expect much better numbers in February. When the weather finally warms up, this economy will be back to “normal” (whatever normal means today) and growing at a nice steady rate. Bad weather in the United States is not the reason for the January stock market decline.

- The Fed announced it would begin to “taper” the amount of bonds it will purchase each month from $85 billion to $75 billion. This was supposed to drive interest rates higher. Right? With less demand for the purchase of bonds, prices would decline and interest rates would increase. Right? So why did the interest rate on the 10-year Treasury bond decline from 3% at the end of the year to 2.64% at the end of January? It turns out that the Fed’s QE (Quantitative Easing) had very little to do with interest rates going down, and the absence of QE is not going to make interest rates go up. Fed tapering is also not the reason for the January stock market decline.

As I stated earlier, the market sold off in January because it was time for it to sell off. It will likely decline more before it goes higher. Don’t get too excited about it. Yet.

With the 10-year Treasury bond trading at an interest rate of 2.7%, we have had a nice rally in our fixed income portfolios. We don’t anticipate that interest rates will trend much lower. However, although we think we will see 3% again this year, we are not worried that interest rates are going much higher either. We feel the economy will continue to grow at a slow steady rate, and it will take a much faster pace of growth to cause higher interest rates to become a concern.

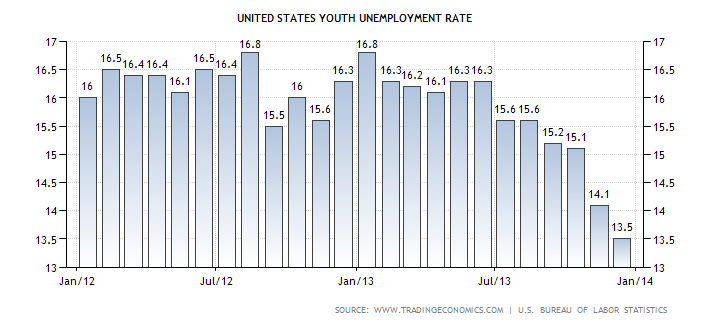

Remember Occupy Wall Street (OWS)? Two years ago, young people (mostly) were living in tents in New York City’s Zucotti Park protesting income inequality between the top 1% and the other 99%. OWS quickly spread to other cities throughout the world. I wrote in my 2011 November Investment Commentary (see Toma La Calle) that the Occupy Wall Street phenomenon was nothing more than a manifestation of high unemployment. Unemployed young people were whining about unfair compensation for CEOs, but what they were really concerned about was their lack of any compensation…because they didn’t have jobs.

I predicted that if unemployment declined, OWS would disappear. According to the chart above, youth unemployment is clearly much lower now. Unfair CEO compensation is as bad or worse than it was two years ago, but Occupy Wall Streeters have become “Occupy Little Cubicles for Rent Money.” It may not be much, but it is better than living in a tent in a concrete park…especially this winter.

At Boyer & Corporon Wealth Management, we feel there is a good likelihood of this stock market continuing to correct somewhat. To that end we have written/sold call options against many of our equity positions. We are more than willing to be called away at higher prices. In our fixed income securities, we are maintaining a fairly short duration with the exception of our position in zero coupon municipal bonds, which became unrealistically cheap twice in the past three years. They are not as cheap as they were last summer, and we will be looking to take profits in a few of them.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.