“Invest your money with me. I guarantee I’ll give you back less than what you invested.” This is what investors are hearing all over the world as over $10 trillion of sovereign bonds are trading at negative interest rates today.

That’s right, if you invest in bonds issued by Germany, Japan and several other legitimate nations, you are guaranteed to receive back less than what you invested.

How did we become so desperate? What is it that makes people invest $10 trillion at a negative interest rate?

The last week of May found me and Cory Bloodgood at the Strategic Investment Conference in Dallas. Bottom line from three days of speakers? Run for cover. Buy gold, water and ammunition. Round up the kids and find shelter. Find Dorothy. And buy negative interest rate bonds.

Okay, maybe not negative interest rate bonds, but the speakers at this conference certainly gave us many reasons to be concerned. (Although one always needs to remember that the stock market climbs a “wall of worry.” Just because the world seems to be on the brink of financial disaster doesn’t mean the stock market won’t hit new highs.)

They gave us many reasons to worry, but a common one is the massive debt that has been amassed by all of the major economies: the U.S., Japan, China and almost every European country.

Very simply put, when anyone borrows money, they are taking money from tomorrow so that they can spend it today. That means, of course, they will not be able to spend it tomorrow. The only way to spend money tomorrow is to borrow more money, ostensibly from the next day.

They might be able to keep this up for a long time, particularly if they happen upon a gullible lender. But even gullible lenders (like anyone who EVER lends to Greece) eventually run out of money or the willingness to be the sucker who lends money to deadbeats.

When they hit the “way too much debt” wall, they can no longer spend until they pay back some of the debt. (Or you do like Greece does. Go to the world equivalent of PayDay Loans.) During the repayment period, their own personal economic activity slows down. This is also known as “austerity.”

And “austerity” is what the world is facing eventually. The acts of saving and paying down debts will be thrust upon the world, more like an “involuntary austerity.” Also known as a recession.

But hopefully not a depression. Large economic downturns like depressions lead to geopolitical changes that are not necessarily good. Powerful people use bad economic times to control the not-so-powerful people. Democracy becomes fragile and voters (if they are still allowed to vote) sometimes vote for things that sound good, but aren’t.

This week, the Federal Reserve announced they will NOT raise interest rates this month, even though most people had been thinking they would. Many “experts” feel the Fed SHOULD raise rates… that keeping them artificially low is actually detrimental. Maybe it is detrimental.

It doesn’t matter. With $10 trillion of bonds from other countries trading at negative interest rates, it’s next to impossible for the Fed to raise interest rates. Investment funds all over the world are always looking for the best return they can get with the least amount of risk.

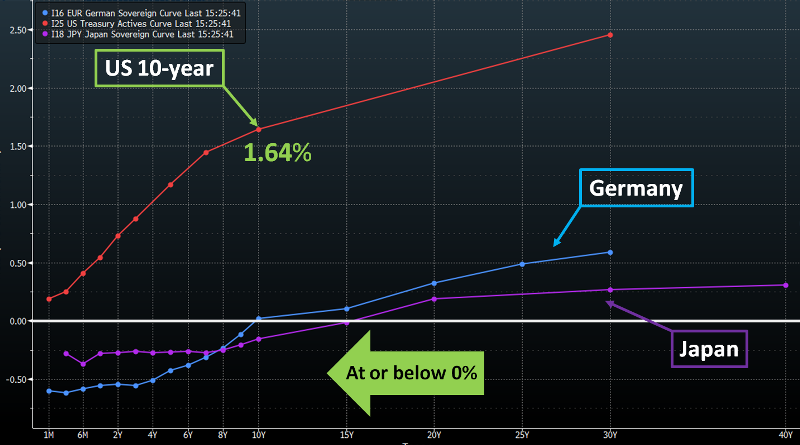

The U.S. 10-year Treasury bond is already attracting a lot of new money, the yield falling from 2.25% at the end of 2015 to below 1.6% today.

The chart below shows the 10-year U.S. Treasury relative to Japan and Germany.

If they had raised the Fed Funds rate, the U.S. arguably would be offering the highest rate of return in the world with a relatively safe rate of return (“relatively” being the key word in that phrase). A higher rate attracts more investors, thus driving the value of the dollar higher relative to other currencies. A higher dollar makes our goods more expensive to foreigners, reducing the amount we export.

Our economy, which is already running like “The Little Engine That Couldn’t,” will sputter. In addition, China, whose currency is “somewhat” pegged to the dollar (no, I don’t understand that either), will experience the same problem “somewhat.” That will make China “somewhat” unhappy because China is much more dependent on exports than the U.S. Therefore, China no doubt put a little pressure on the Fed to leave rates alone.

At Boyer & Corporon Wealth Management, we continue to extend our durations because we don’t see higher interest rates for a long time to come. We are not running from the stock market (yet), but are keeping a close watch for the return of volatility. Markets don’t like volatility.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.