CNBC is in big trouble. The Dow Jones Industrial Average (DJIA) finally broke through 20,000, and now the network is going to have to find something else to talk about. Its anchors have been anticipating this breakthrough for weeks and talking about it frequently almost every day, flashing ridiculous headlines on the screen that the Dow is “nearing” or “approaching” or “inching toward” 20,000.

It’s as if 20,000 is some incredibly magical number, much more powerful than 19,999 and more meaningful than 20,001, even though 20,001 is higher. The day the DJIA broke through 20,000, it actually closed at 20,068, but the 68 meaningless points above 20,000 were not discussed.

What’s missing is the fact that this whole charade is extremely stupid. “The Dow” is talked about as if it is some meaningful indication of what is going on in America. You are led to believe it is an index that should matter.

It isn’t.

It doesn’t (matter).

The Dow Jones Industrial Average Index is comprised of 30 companies. JUST THIRTY! If you ask your average American, he or she will not be able to tell you that there are 30 stocks in the DJIA. Try it now. Ask people nearby and see what they say.

For a better indication of how the overall “market” is performing, check the performance of the Standard & Poor’s (S&P) 500 index, which is comprised of 500 companies. For the record, the S&P 500 increased 1.9% in January while “the Dow” rose just .62%.

When I first started working in the investment industry in 1981, stocks in the DJIA included Sears Roebuck & Company and Woolworth. There is an entire generation today that has never heard of Woolworth.

Every now and then the brain trusts who oversee this overrated index realize that a couple of companies in it are almost obsolete and render the Dow even MORE irrelevant than it already is. So, they make changes by deleting those companies from the index and replacing them with new, more relevant companies.

Just during my career, the following stocks have been removed:

1982 – Johns Manville Corporation

1985 – American Tobacco (back when it was still fashionable to smoke on an airplane); General Foods

1987 – INCO (no kidding, I’m sure you have never heard of INCO); Owens-Illinois

1991 – American Can Company; Navistar Corporation; USX Corporation

1997 – Bethlehem Steel; Westinghouse; Venator (name changed to Venator from Woolworth… changed again in 2001 to Foot Locker, which is a MUCH better name than Venator)

1999 – Chevron; Sears Roebuck & Company; Union Carbide; Goodyear Tire & Rubber Company

2004 – Eastman Kodak (that was only 13 years ago!); AT&T (which, ironically is actually IN the Dow today because SBC Corporation was renamed AT&T after acquiring AT&T. Go figure); International Paper

2008 – Altria Group (more cigarettes… formerly Philip Morris); Honeywell (replaced by Chevron, which had been kicked out in 1999, but the brain trusts had a change of heart and put Chevron back in)

2008 – (seven months later in the same year) American International

2009 – Citigroup; General Motors

2012 – Kraft Foods (yes, macaroni and cheese in a box was in the Dow)

2013 – Alcoa; Bank of America; Hewlett Packard

2015 – AT&T (the only name to get kicked out TWICE!)

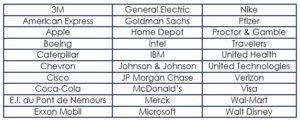

Here are the companies that make up the Dow today:

If you wonder sometimes why your portfolio isn’t doing the same thing as the Dow Jones Industrial Average, it’s probably because you don’t own those 30 stocks.

I spent a little over a week in Italy recently, and I took the opportunity to query some Europeans about the results of our recent presidential election. I already know what Americans think. Just like after previous elections, half of Americans are happy and half of them are not.

Granted, I only spoke with a relatively small number of Europeans since I was only in Florence and Rome. And this was not a controlled experiment as my questions were random, haphazard and usually quite a surprise to the victim. Nevertheless, I thought it might be interesting to get a small taste of how non-U.S. citizens viewed our election results.

The most common response was something like, “We hope Trump turns out to be a good president because we need for him to be a good president.” The inference being that the rest of the world still very much relies on the U.S. for safety, freedom and free trade. The rest of the world still understands that what is bad for the most powerful country in the world is bad for the rest of the world. And make no mistake about it… they still view the U.S. as the most powerful country in the world.

The wittiest response, of course, came from a Brit. He quipped, “You guys ‘Trumped’ our Brexit!”

Since the Dow broke through 20,000, the stock market has lost some steam. It appears that the “Trump rally” may have run its course, and investors will now start paying attention to corporate earnings and other such foolish fundamentals.

From the day before the election until January 25th, the S&P 500 increased 7.8%, presumably because investors think President Trump’s policies will prove to be pro-growth. (During the same period “the Dow” increased 10%.) The market gave up 1% in the last week of January. The honeymoon may be over.

We didn’t get too excited about the rally because (as we have always said) the president of the United States does not move the economic needle as much as the investing public thinks he does. There are much larger global economic and geo-political issues that pre-exist any president’s inauguration.

Investors are frantically trying to gauge the effects of Trump’s travel ban and his possible “border tax” and “corporate tax reduction” and whatever else he is trying to enact in his first 100 days. And let’s face it, he seems to be busier than your average post-inauguration president.

Meanwhile 4th quarter GDP came in at a measly 1.9%, reminding everyone that we still have a long way to go.

At Boyer & Corporon Wealth Management, we are not making any special changes to our portfolios just because Donald Trump was elected president. We still think stocks are not cheap and are watching carefully for signs that the stock market might not be as friendly over the next 12 months. Having said that, we are not in a panic to reduce our exposure to the stock market yet. Market timing has proven to be a very humbling experience.

We don’t think interest rates will move up significantly, even though there are some small signs of inflation recently. If we continue to see more evidence that inflation is becoming a more reliable trend, we will revisit our fixed income securities, shortening our duration. Meanwhile, we are inclined to think interest rates will likely trend lower now that the Trump rally seems to have run its course.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.