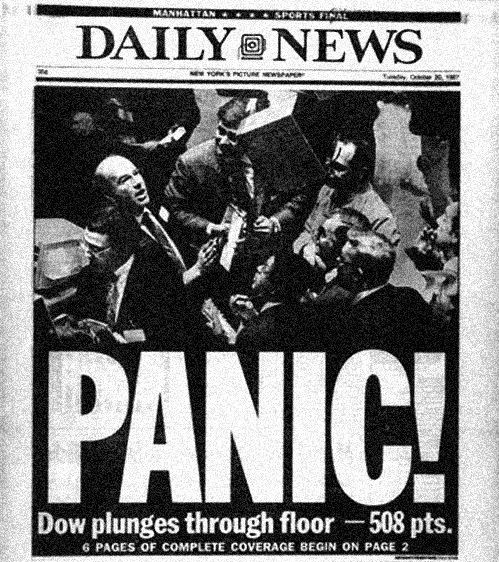

Thirty years ago today, the U.S. stock market experienced the biggest single-day decline in history. On Monday, October 19, 1987, the Dow Jones Industrial Average (DJIA) plummeted 23%. That day has since been referred to as “Black Monday.”

To put that into perspective, the previous largest one-day sell-off was on a Monday in October 1929. That day, the market lost a little over 13%, and it was the start of a decade known as “The Great Depression.”

On Black Monday, Richard Boyer was a 33-year-old, very green stockbroker working at a Wall Street firm called Kidder, Peabody & Co. in Kansas City. It would be another seven years before the Boyer & Corporon partnership was formed. Richard vividly remembers October 19, 1987:

“At the time, I didn’t understand the reasons for the market decline, although I was clearly not in the minority. On that day, very few understood what was happening and why.”

Midway through the day, Richard felt like it would be a good idea to call his clients and let them know about the carnage in the market.

“One of my first calls was to a gentleman who owned a lot of ‘blue-chip’ stocks like AT&T, General Electric, Philip Morris, and Procter & Gamble. For whatever reason, I thought he ought to know he was losing a ton of money. I didn’t have any plan or recommendation. Quite frankly, I’m not sure there was anything anyone could do at that moment, but I thought I should call him anyway.”

After describing to his client the terrifying scene being played on Wall Street, Richard’s client laughed out loud. “That was not the reaction I expected,” remembers Richard. His client chuckled and said, “I wasn’t gonna sell them if they were up. Why would I sell them because they’re down? Go call someone else who needs to hear from you.”

“I didn’t realize the importance and significance of that call until many years later, but I never forgot that call,” Richard says.

Several years ago, that gentleman passed away and his widow is still our client today. On the day he died, he still owned almost all the same stocks that he owned on October 19, 1987.

That’s right. He rode them down that day and then rode them back up for the next 20+ years. He got back that “ton of money” he lost on October 19th, and he made TONS more by not panicking and holding on to his investments.

In 1987, he understood so much better than most what an “Investor” is. An investor understands that they own shares of a company . . . a company that sells products and makes profits and pays dividends.

He realized better than most that he didn’t just own numbers on a TV screen or numbers in a newspaper. He realized that, despite what other people are willing to pay him for his shares today or tomorrow, the shares of his company were going to pay him dividends in cash every three months.

He realized better than most that his net worth wasn’t the value of his shares on any given day. His net worth was the “present value of all the future cash flows (dividends) of the companies he owned.”

Richard describes this experience on Black Monday as one of the most valuable lessons he has learned in his 36-year career.

At Boyer & Corporon Wealth Management, we invest in companies that sell products and provide services. We try to help our clients maintain a laser-sharp focus on their long-term goals and do not let emotion affect our investment decisions.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.