Recently, we attended a couple of industry conferences… conferences loaded with “knowledgeable experts” who somehow manage to disagree with each other from time to time. Disagreements aside, we came away with several nuggets that we feel will help us negotiate the securities markets today. Here are several of them:

- Our long-held view that interest rates will remain low has not changed. Even though 222,000 new jobs were created in June and unemployment remains low at 4.4%, massive global debt will continue to be an insurmountable hurdle to robust global economic activity.

- Fuel prices will remain under control. Shale fracking has made the United States virtually energy independent; a concept we couldn’t even imagine 15-20 years ago. This has several important implications:

- Companies that rely on fuel as a major component of their expense structure should experience more predictable earnings results. A good example of this is airlines that have always been at the mercy of unpredictable jet fuel costs. Not so much anymore.

- The United States will have less need to be a global sheriff since our dependence on the Middle East for oil has been eliminated. Expect hot spots all over the globe to become hotter as our military forces pull back somewhat.

- Countries that have unexplored reserves may find themselves in the position of needing to extract those reserves as they find it more and more difficult to import oil in a world that no longer has a global sheriff. The large exploration and production oil companies would be the beneficiaries in this scenario.

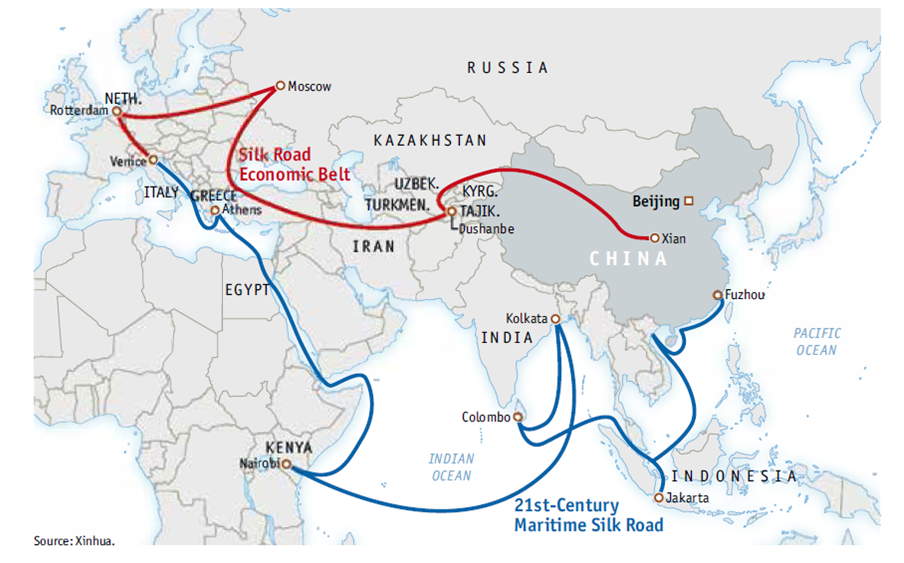

- China is no longer the world’s low-cost manufactured goods producer. Decades of cheap products labeled “Made in China” are giving way to countries like Mexico and Vietnam that are undercutting China’s labor costs by a significant margin. Since China can’t rely as much on exports for growth, it is trying to become a more consumer-based economy. To that end, China has begun the “One Belt, One Road” (OBOR) initiative, a plan to become the economic center of the world. The One Belt, One Road initiative is a huge infrastructure buildout across land and maritime routes, creating special economic zones all over the world to promote trade.

OBOR notwithstanding, we don’t expect China to become the world’s future super-economy and we don’t expect their currency to usurp the dollar as the world’s main currency… ever. At least not in our lifetimes.

The current economic expansion is now eight years old and one of the longest (and most anemic) expansions ever. Signs (and experts) all over the place point to the inevitable stock market correction. And, if there is one thing we have learned, it’s that stock markets rarely behave the way “experts” expect them to. Although we are not predicting an “expensive” stock market to continue to get more expensive, we have learned to not be surprised with anything the markets do.

Here’s something to think about… given that the U.S. is now energy independent, a case could be made that the next decade could be one of the best decades in the history of our nation. No more oil price shocks. No more keeping world order so that we can get oil from the Persian Gulf. Although we still have $19 trillion in debt, it’s conceivable that relative to the rest of the developed world, the U.S. is in the catbird seat geographically, economically and militarily.

Of course, there are things to be concerned about. There always are. Student loan debt, unfunded pension plans, potentially rising interest rates, health care costs and Medicare for Baby Boomers. But all of these concerns are “known” and baked into market prices. None of them give us very much angst.

The economy could keep on chugging and the stock market could continue its ascent during a period of “knowns.” It’s the “unknowns” that give us angst. And the biggest unknown is North Korea.

____________________

The Fed raised short-term interest rates in June and is widely expected to raise rates again at least once more this year. This is another economic issue that does not bother us. Despite low unemployment, wage inflation seems to be nonexistent. Therefore, overall inflation remains under control.

At Boyer & Corporon Wealth Management, we see interest rates remaining low and would use any increase in long-term rates to lengthen the duration of our portfolios.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.