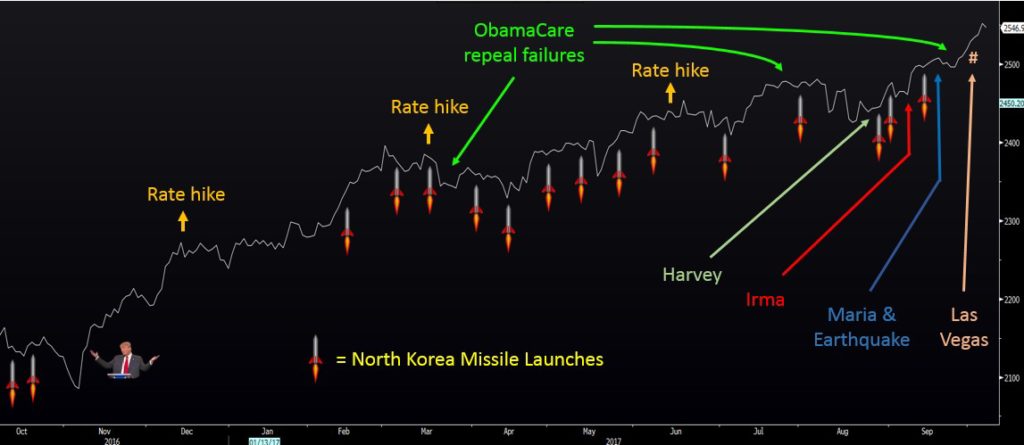

Threats from North Korea, mass-murder in Las Vegas, major hurricanes hammering Texas and Florida, earthquakes in Mexico, and more terror attacks in Europe . . . clearly an environment that would have investors running for the exits.

Yet, despite this deluge of disaster, the stock market has persisted to be strong this past month, rising 2%. It is remarkable to watch the global equity markets consistently climb day after day, month after month, regardless of how much bad news hits the airwaves. How is this so?

The graph below illustrates various significant events throughout the past twelve months and the steady climb of the S&P 500 during that period.

Boyer & Corporon Wealth Management

Boyer & Corporon Wealth Management

Since Donald Trump was elected president, the S&P 500 has increased almost 20%. If you are a right-wing Trump supporter, you can point to this as validation that Trump is doing all the right things. If you are a left-wing Trump hater, this is nothing more than obvious proof that there is absolutely no correlation between presidential performance and stock market returns.

So why do stock markets go up when conventional wisdom (oxymoron?) says that maybe they ought to do otherwise? Because conventional wisdom tends to focus on all the things it’s unwise to focus on (hurricanes, disasters, and potential disasters) and doesn’t pay attention to the things that count.

“It’s the economy, stupid” is the most famous phrase from the successful Clinton presidential campaign (not to be confused with the most recent “unsuccessful” Clinton presidential campaign).

It was true then and it’s still true. The U.S. economy, while growing very slowly for the past nine years has been, well . . . GROWING the past nine years.

News of the sort presented in the graph above is shrugged off in positive, growing economies. In negative, shrinking economies, they have the opposite effect, and make it very un-fun to be an investor.

After multiple failures to repeal the Affordable Care Act (ACA), there was some pessimism that the GOP would be able to push through tax reform in 2017. But the prospects brightened on Thursday, when the House agreed on a 2018 budget resolution.

As explained in our April commentary, “Reaccommodate,” it seemed unlikely that Republicans would work with Democrats to build a bipartisan tax plan. Indeed, it’s now clear that they plan to use a legislative process created by the budget resolution called “budget reconciliation.” The reconciliation process eliminates the filibuster and essentially allows Republicans to push through their agenda via a simple majority vote in the Senate (as opposed to the 60 votes usually required). This should be fairly simple given that Republicans make up 52 of the 100 seats in the Senate. “Should” being the operative word, since Republicans have had a hard time garnering even 50 votes in multiple attempts to repeal the ACA. As we’ve said before, having a Republican majority in Congress doesn’t necessarily translate into smooth sailing for a president who is neither a Democrat nor a Republican.

Friday’s job report was a head scratcher. For the first time in seven years, the reported number of people employed in the U.S. declined. One would think that a decline would coincide with a rising unemployment rate. Surprise! The unemployment rate also declined . . . to its lowest level in seventeen years!

Boyer & Corporon Wealth Management

Boyer & Corporon Wealth Management

How could this be? First, any economic data from September is specious due to the effect of the hurricanes. Second, each of these data points comes from a different survey. One survey asks employers, “How many people do you pay?” and the other survey asks employees, “Are you employed?” Harvey, Irma, and Maria likely prevented many workers from doing their jobs. Therefore, companies paid fewer workers for the month. However, those workers do not refer to themselves as unemployed. They assume they are going back to work soon.

One other data point that came out of the jobs report was a healthy 2.9% increase in average hourly earnings (year-over-year). This number will most certainly be on the Fed’s mind the next time they meet, as it indicates that inflation might be creeping into the economy.

At Boyer & Corporon Wealth Management, we keep a close eye on inflationary signals and do not yet believe there is reason to be fearful of runaway inflation. As such, the duration of our fixed-income securities remains relatively long.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.