The investment industry has a knack for blowing things out of proportion. Using buzz words like “guaranteed” or “tax-free”, investment salespeople are constantly figuring out ways to get investors to move money from one place to another. Some gimmicks are downright criminal. Some are very legitimate but over-rated, like converting your Traditional IRA into a Roth IRA.

The investment industry has a knack for blowing things out of proportion. Using buzz words like “guaranteed” or “tax-free”, investment salespeople are constantly figuring out ways to get investors to move money from one place to another. Some gimmicks are downright criminal. Some are very legitimate but over-rated, like converting your Traditional IRA into a Roth IRA.

You may have heard about the benefits of converting Traditional IRAs into Roth IRAs. And there definitely are some legitimate benefits. What you likely have not heard is why Roth conversions can possibly be destructive to your family wealth.

In a Roth conversion you take funds out of a Traditional IRA, pay ordinary Federal and State income taxes on that amount, and then move those funds into a Roth IRA where they grow tax-free. You can see that this has very little to do with investments and a lot to do with taxes.

Ultimately, the decision of whether to convert funds from a Traditional IRA to a Roth IRA should primarily be driven by comparing your tax rate when you are going to “convert” your Traditional IRA to the forecasted tax rate when the funds would have otherwise been distributed. If the forecasted tax rate is higher, then it is better to convert now to a Roth IRA. If the forecasted tax rate is lower, then it is better to leave the funds in the Traditional IRA and pay taxes later upon distribution.

It goes without saying (but we will say it anyway), that you want to PAY income taxes when you are in LOWER tax brackets and you want to AVOID (not to be confused with evasion, which is illegal) income taxes when you are in HIGHER tax brackets.

If you are still working, it is likely your current tax rate (on wages and other income) is higher than what your tax rate will be in retirement.

If you are relatively wealthy (just because there is someone who has more than you does not mean you aren’t wealthy), it is likely current tax rates will be higher versus what the tax rate will be for your beneficiaries who are going to inherit your IRA.

Following is an example to illustrate how a Roth conversion could be a bad idea:

- A single mother has $1.5 million in a Traditional IRA and $652,587 in a taxable (non-IRA) brokerage account. She also has a really good job. With taxable income of $200,000 she is in the 33.0% Federal tax bracket and 5.0% State tax bracket (38.0% combined).

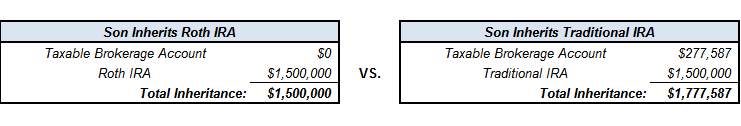

- In order to leave a tax-free Roth IRA to her son, she converts the entire $1.5 million Traditional IRA. In doing so, she owes approximately $652,587 in taxes because the large conversion fills up all Federal tax brackets (43.5% combined effective rate). If she dies shortly thereafter, her son would inherit a $1.5 million Roth IRA but the taxable account was exhausted to pay the taxes incurred by the conversion.

- Her son is 30 and a park ranger in Texas. His modest income puts him in the 25.0% Federal tax bracket with plenty of room to spare. Texas has no State income tax. Had he simply inherited the $1.5 million Traditional IRA he would have paid taxes at a rate of only 25.0%, stretched out over many years, because required minimum distributions (RMDs) for a beneficiary his age start at less than 2% of the account balance.

- By inheriting the $1.5 million Traditional IRA the son would ultimately face only about $375,000 of taxes (paid from the taxable account)… compared with the $652,587 his mother would have paid to convert it… resulting in an additional inheritance of approximately $277,587.

If you are in a high tax bracket and are charitably inclined, it might be even more appealing to avoid conversion to a Roth IRA. You can name a qualified charity as a beneficiary of the Traditional IRA (0% tax rate) and use other taxable assets to satisfy bequests to heirs.

Clearly, conversions to Roth IRAs often have merit; however, they are not the “no-brainer” many think they are. We at Boyer & Corporon Wealth Management are not tax professionals. However, we are always available to work with you and your tax professional when considering strategies such as this.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.